Authors

Giana Lin, giana.lin@fuguanlaw.com, Partner, The FUGUAN Law Firm (B Corp Certified)

Daisy Ying, daisy.ying@fuguanlaw.com, Lawyer, The FUGUAN Law Firm (B Corp Certified)

Introduction

Participation in public welfare and charitable activities is a kind of value creation of enterprises, with a positive impact on the brand reputation, market share, goodwill and employee satisfaction of enterprises.

In the global information age, enterprises have gradually evolved from the traditional supply chain of “supplier-enterprise-customer” into a more complex enterprise ecosystem consisting of suppliers, enterprises, customers, governments, stakeholders and even the whole society. In this connection, the business philosophy of enterprises needs to change from the traditional pure pursuit of profit maximization to the pursuit of common value maximization, assuming responsibility for consumers, communities and the environment.

For every enterprise, engaging in the public welfare and charity activities is not only a simple charitable behavior, but also a manifestation of social responsibility. Only by committing to charity can the enterprise maintain a high degree of humanistic feelings in its development and bind its business development with social progress while enhancing its internal cohesion. Only in this way can enterprises accumulate more popularity and development momentum and achieve greater future development.

With the opening-up of the Chinese market, more and more enterprises are doing business and projects in China, but they are not so smooth with public welfare and charity activities in China as they are with their business. Since February 25, 2021, when China declared comprehensive victory in the battle against poverty, China is no longer a land of “absolute poverty”, posing a question as to whether funding for poverty alleviation is needed. The fact is, however, other than a simple financial support, modern public welfare has long engaged with new areas such as education, culture, innovation, environmental protection and sustainable consumption, and cause-related marketing that combines a product with a cause may lead to both commercial success and good brand goodwill.

Public welfare and charity law is a kind of social law, with strong regional characteristics and differences in regulations between the countries. The absence of understanding of China’s public welfare laws and regulations has made many enterprises hesitate to engage in the public welfare and charity activities for worrying about failure and backfire due to non-compliance with relevant regulations.

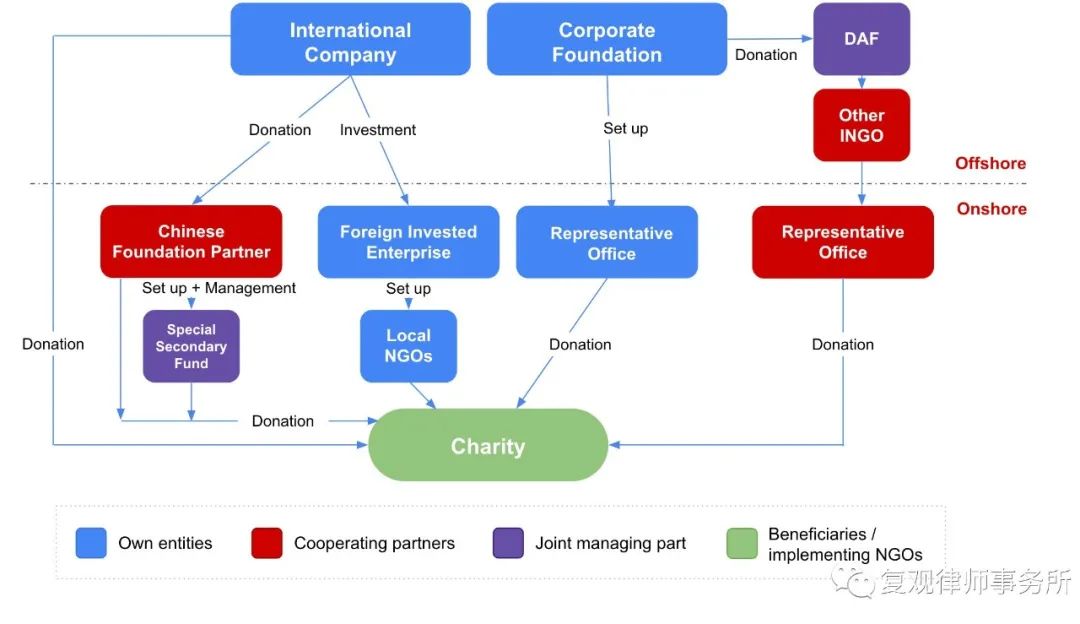

At present, there are already quite a few practical cases of foreign invested enterprises initiating and establishing non-profit organizations in China. Below is an overview of common patterns for Foreign Invested Enterprises to participate in public welfare and charity practice within the territory of China:

Based on the author’s understanding of the charity laws and practices in China, this article will introduce three common models to public welfare and charity activities engagement in China:

Model 1 Direct funding of projects by enterprises

Enterprises can combine their products with public welfare activities and fund Chinese charitable organizations to carry out public welfare projects. For example, a foreign bank has invested funds to carry out public welfare financial education activities, which are closely related to the bank’s business and can leverage its professional ability in the financial field.

Furthermore, enterprises can select public welfare projects and fund multiple projects. For example, in 2000, a U.S. Motor (China) Co., Ltd. established the “Car Environmental Protection Award” in China, funding a total of 471 outstanding environmental protection projects or organizations with a total amount of RMB 28.6 million by the end of 2020.

In general, due to the limited staffing of the public relations departments or social responsibility departments of the enterprises responsible for public welfare and charity activities, enterprises do not invest their own staffing in carrying out public welfare and charity projects. Instead, they often choose to fund other NGOs (i.e., the executor of public welfare activities) to do the job. In this process, enterprises need to find excellent project plans as well as NGOs that are open, transparent, and with standardized internal governance. This is, however, not easy. Compared with the nearly perfect procurement system of enterprises, the funding system of enterprises is still rudimentary. Based on our years of experience serving foreign enterprises, we have learned that when enterprises directly fund projects, it is vital to fund projects effectively and find local NGOs to implement them efficiently.

We have assisted many enterprises in setting up funding systems, establishing a compliant funding system framework, and providing detailed and executable SOP. Under our services, many enterprises have established funding systems and organically combined their products with public welfare activities, realizing the integration of commercial and public welfare values.

Modul 2 Establishing special funds or charitable trusts

Individual and sporadic public welfare project funding may be achieved through the enterprises’ public relations departments or social responsibility departments. However, if the staffing is insufficient for multiple public welfare projects, many enterprises will establish special funds or charitable trusts under Chinese philanthropic foundations.

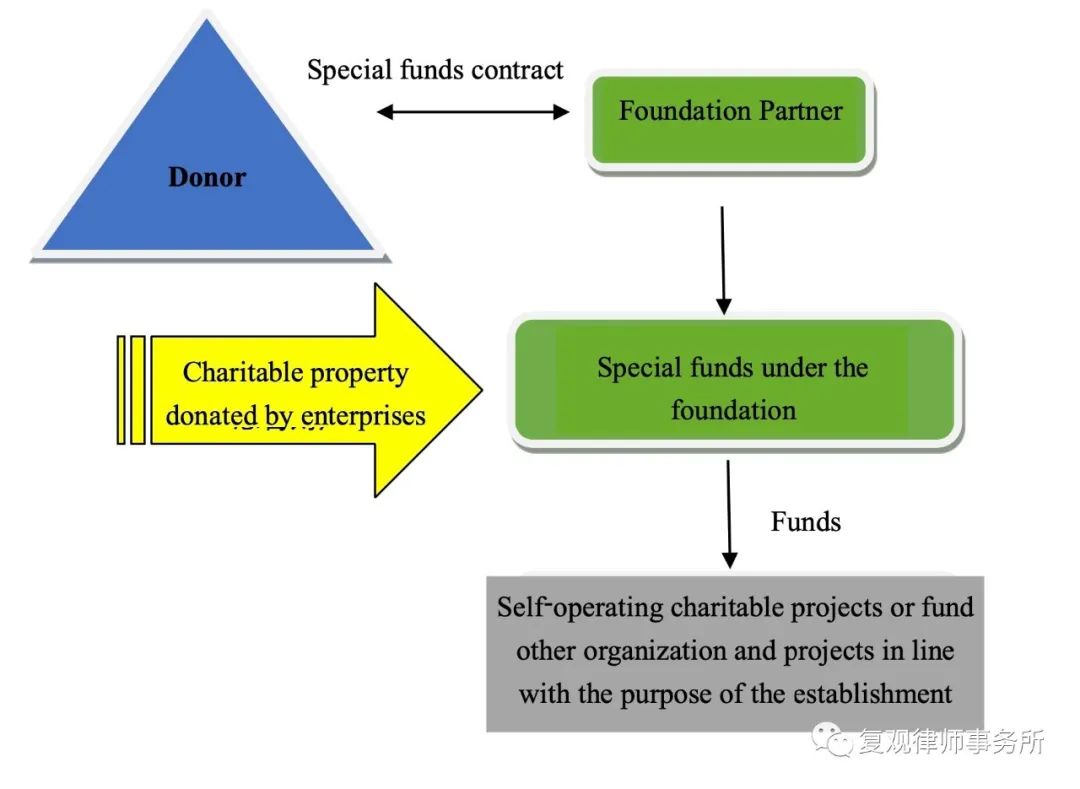

1 Special Funds

Enterprises that establish special funds will usually cooperate with foundations qualified for public fundraising. The special funds established in this way can either fund public welfare projects or receive public contributions after the projects mature. For example, a cosmetic company launched the Shanghai Foundation cosmetic Gratitude Special Fund in Shanghai, committing to public welfare projects related to education, culture, and health for women and children. Compared with self-funding, selecting special funds can get the assistance of cooperative foundations in the process management and capital supervision of the funded projects so that enterprises can invest less human resources.

Such a type with special funds is similar to DAF funds in the US, which is popular among enterprises in recent years. Generally, cooperative foundations have preferential tax status. Therefore, enterprises can receive certain tax preferences if they donate to foundations, although foundations will also charge certain management fees.

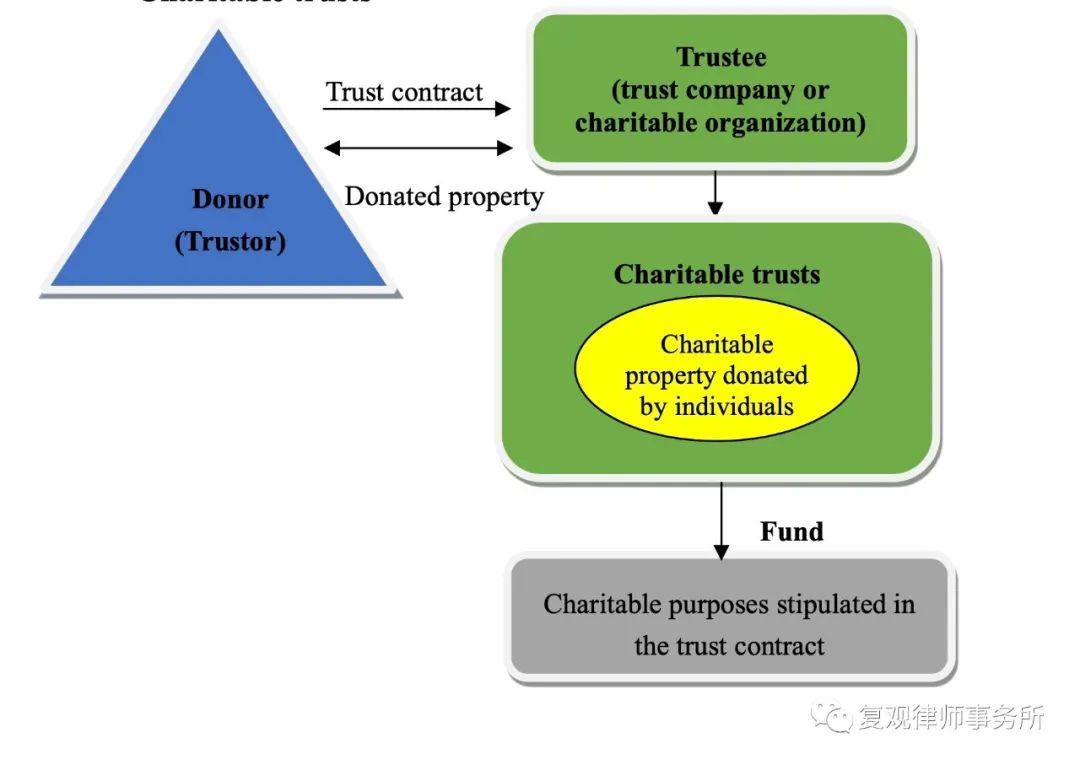

2 Charitable trusts

In addition to establishing special funds, enterprises can also establish charitable trusts. Charitable trusts generally have trust companies and other financial institutions as trustees, who have more professional experience in maintaining and increasing the value of funds with a stricter internal control system for fund allocation. Charitable trusts have only been gradually developed since the promulgation of the Charity Law in 2016; hence, they are still not particularly mature compared with special funds, especially in the absence of preferential tax policies and lack of experience acting as trustees in charitable project management.

Modul 3 Establishing domestic NGOs to donate /implement charitable activities

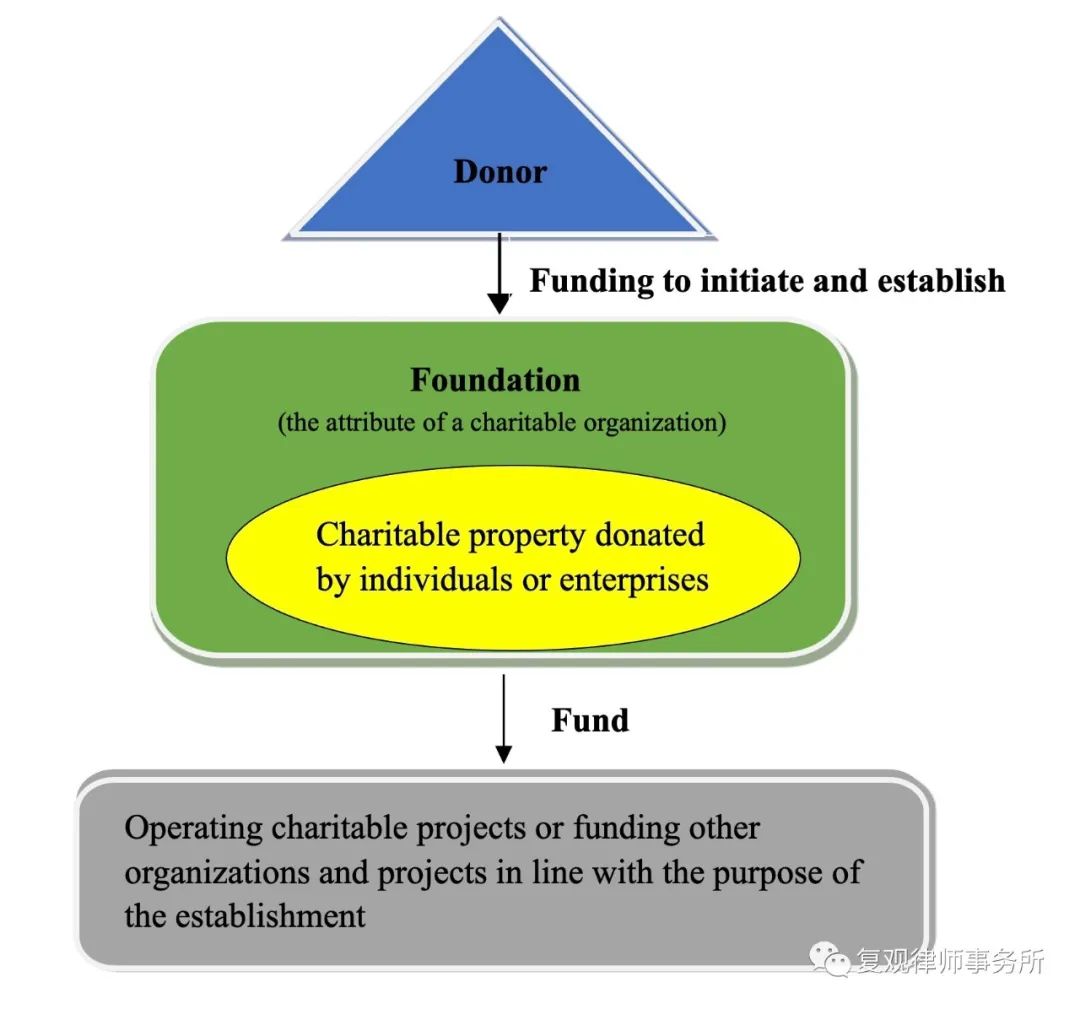

After years of experience in public welfare activities, enterprises will generally choose to establish public welfare organizations to realize their vision of public welfare better. Enterprises tend to establish corporate foundations, for example, one Beijing coffee Foundation sponsored and established by a famous coffee company in 2020 and committed to giving back to the local community. From the perspective of project operation, corporate foundations established by enterprises can be divided into grant-making foundations and operational foundations. Different operating modes have their advantages and disadvantages regarding professionalism and flexibility.

As the name suggests, a grant-making foundation is a foundation that does not implement projects by itself. Its funds are mainly used to fund some public welfare projects or organizations in line with the foundation’s purpose. For a grant-making foundation, its priorities fall on project approval, selection, evaluation, and supervision. The success of projects funded by a grant-making foundation is, in addition to its strategic management and project management level, primarily affected by the implementation level of external executing agencies.

Unlike a grant-making foundation, an operational foundation tends to have its project implementation team. An operating foundation tends to give little external funding and mainly uses its funds to run its public welfare projects. External implementation agencies rarely influence the success of an operational foundation’s project, and it has sufficient initiative over the project itself. On the other hand, an operating foundation requires a well-structured and well-trained team to run projects, leading to a slightly higher organizational cost. In practice, some operational foundations outsource part of the tasks of their operational teams to professional organizations. In this way, they can save on the cost of team training and cooperation and implement and manage their projects in the most efficient way.

Establishing a foundation requires a higher cost than other types of NGOs, but on the other hand, this model will have more independence than Model 1 and Model 2.